PRESENTED BY BETTERIDGE’S LAW

Is Cyclone Batsirai Front-Page News in the United States? The city of Mananjary in Madagascar has been “completely destroyed” by Cyclone Batsirai, which struck this weekend, the second in two weeks. A humanitarian crisis is feared.

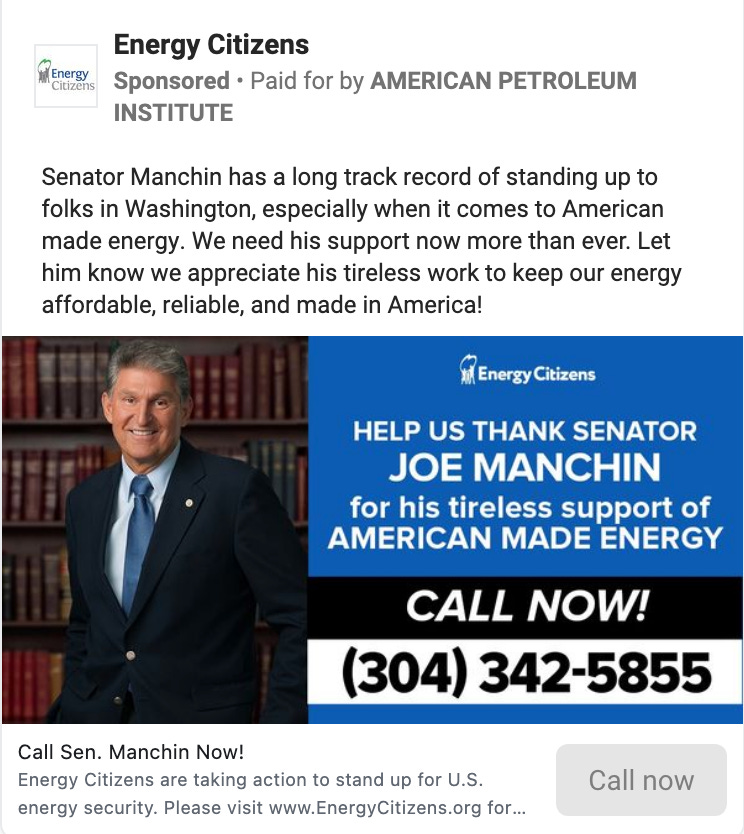

Is Facebook Shutting Down Climate Misinformation? I apologize for again including a screenshot of a fossil-fuel ad in the newsletter, but there are so many. In ads on Facebook, the American Petroleum Institute has been encouraging West Virginians to call Joe Manchin (D-W.Va.) to take Build Back Better out back and shoot it dead. As Vice’s Greg Walters reports, the ad campaign ended the day Manchin went on Fox News and announced he wouldn’t vote for it. The API ads also targeted the constituents of Sen. John Hickenlooper (D-Colo.) and Kyrsten Sinema (D-Ariz.), among others.

Weird how API members Shell and BP claimed to support Build Back Better.

Of course, that’s not all. “InfluenceMap estimates that oil companies and groups spent a combined $22.2 million on Facebook ads in 2020 and 2021, including the likes of ExxonMobil, Chevron, BP, the American Petroleum Institute, and the Texas Oil and Gas Association.” An earlier InfluenceMap report found that fossil-fuel Facebook ads got at least 431 million views in 2020. However, as Walters reports:

“A spokesperson for Facebook’s parent company, Meta, pointed out that TV networks also play ads promoting fossil fuels.”

Well, okay then.

WINTER OLYMPICS BREAK: SKELETON

Is Capital Going To Save the Climate? The folks who own approximately everything—asset managers including BlackRock, JP Morgan, Fidelity, Wells Fargo, and State Street—have come together in the Climate Action 100+ coalition, and got a lot of great press for doing so. As it turns out, they aren't actually acting on climate, funny thing. A report from Majority Action shows how the coalition members voted against climate resolutions and to keep boards of companies failing to meet climate benchmarks. Notably:

Four of Climate Action 100+’s six “flagged” shareholder resolutions that failed to receive majority support of voting shareholders would have done so, but for votes against the resolutions from these largest Climate Action 100+ investors.

Only 8% of banks “conduct scenario analysis to assess the impact of climate risks and broader environmental risks.”

Thanks to Louie Woodall’s great weekly newsletter Climate Risk Review for the links.

Are World Wildlife Fund’s Animal NFTs Protecting Biodiversity? Because she is made of sterner stuff than I, Kate Aronoff takes this question seriously and offers real insight into the broken model of financializing nature.

Are These Fossil-Fuel Pipelines Inevitable? A hearing last week on the Enbridge Line 5 pipeline project in Wisconsin went for ten hours as over 140 people spoke out against it, spilling over from Wednesday afternoon into Thursday morning. And in other cheering pipeline news, last week the Fourth Circuit vacated the federal government’s approval for the Mountain Valley Pipeline, which is planned to cross through Virginia and West Virginia.

Do You Want More Links? Mount Everest’s ice is disappearing. Hela, the goddess of death, has a podcast. Biden’s Interior reverses a Trump decision on North Dakota mining rights, agrees that “the Missouri riverbed belongs to the Mandan, Hidatsa, and Arikara (MHA) Nation.” A house explodes in Brooklyn. Oil prices — and profits — are surging. Remembering Shenkin the Royal Welch goat. Denmark’s Danske Bank announced it would cut its lending to oil and gas exploration companies by half from current levels by 2030. And Bradley Campbell absolutely rips ISO-New England for yet another “naked attempt to prop up oil and gas at the expense of renewables and state climate policy.”

JERBS: LittleSis is hiring a senior researcher for climate justice ($65K) and a researcher for state power mapping ($55K). The Environmental Defense Fund is looking for a senior policy manger for federal climate innovation (no salary listed). GreenFaith, the multi-faith environmental network, has multiple job openings, including global organizing co-director ($80-$90K), global digital director ($75K-$90K) and climate finance campaign organizer ($60K-$65K). Senator Jon Ossoff (D-Ga.) is seeking a senior-level climate policy legislative assistant (referral number 227361, $75K to $90K).

ON THE HILL THIS WEEK: Tomorrow, the House Oversight Committee hears from climate scientist Michael Mann, Public Citizen’s Tracey Lewis (of late with 350), and shareholder activist Mark van Baal on Big Oil’s disinformation campaigns and the status of their new climate pledges. This hearing is meant to tee up next month’s scheduled hearing with Big Oil board members, who are currently resisting the call to testify.

Also on Tuesday: justice, diversity, and equity in environmental grantmaking; the nomination hearing for Maria Robinson, Joe DeCarolis, and Laura Daniel-Davis, rescheduled from last week; farm policy with undersecretary Robert Bonnie; testimony from stakeholders on the Water Resources Development Act of 2022.

Wednesday: Sen. Mazie Hirono (D-Hawaii)’s national parks subcommittee reviews the implementation of the Great American Outdoors Act; Mine Safety Commission nominees; and votes on the nominations of Shalanda Young and Nani Coloretti for OMB and Dimitri Kusnezov for DHS undersecretary for science and technology.

Finally, representatives from the industry-friendly Clean Air Task Force are testifying in both an EPW nuclear energy hearing on Wednesday and the Senate Energy committee “clean” hydrogen hearing on Thursday, alongside industry representatives, so the full diversity of opinions will be heard.

Because there’s nothing more satisfying for everyone involved than explaining a joke: Betteridge’s Law, a.k.a. Davis’s law, states: “Any headline that ends in a question mark can be answered by the word no.” —@climatebrad